CIPS CONNECTIONS

INTERVIEWS by STEPHEN IBARAKI, FCIPS, I.S.P., ITCP, MVP, DF/NPA, CNPRichard MacKellar: Visionary, Entrepreneur, and Founder/CEO of Brightside Technologies

This week, we have an exclusive interview with Richard MacKellar, Founder and CEO of Brightside Technologies.

Mr. Richard MacKellar is an experienced technology entrepreneur and successful operations manager who, for more than 12 years, has helped small companies grow. Moreover, out of his very busy schedule, he volunteers time to share his highly valued and widely recognized leadership expertise with college students.

Beginning as an engineer with Rolls Royce, Richard went on in 1991 to his first small company, Kevry Corporation. In 1998 he co-founded NxtPhase Corporation, a supplier of digital/optical instrumentation, before taking over the helm of Brightside Technologies in 2003. Brightside is commercializing research from the Structured Surface Physics Laboratory of the University of British Columbia. The company has been receiving wide recognition for its continuing innovation towards a final commercial high dynamic range display product, which is being introduced this year.

Mr. MacKellar holds a Bachelor of Metallurgy (Sheffield University) and an MBA (Harvard Business School.

Discussion:

Q: Richard, you have a proven record of innovation. Thank you for taking the time to share your accumulated insights with our audience.

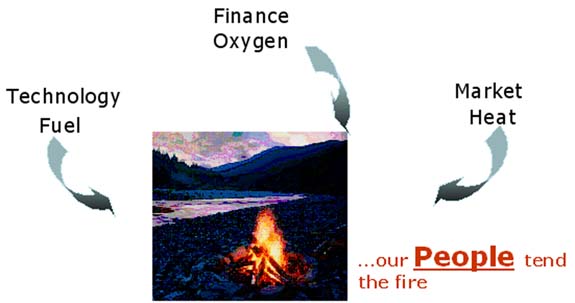

A: I think of building a company in two ways: “Building a Fire,” and “Building a Plan”

1. Building a Fire

Building a company is like building a fire. For a fire we need fuel, oxygen and heat. When considering a company in the technology world we can think of these three elements as follows:

Market = Heat

Technology = Fuel

Oxygen = Financing

There is also an important fourth element: People. Our job as people is to attend the fire and make it grow. At all times we need to keep these three other elements in balance so the fire continues to grow and doesn’t go out. If we get it wrong then we hurt or kill the company.

If we do our job well these elements also build off one another in a continuously growing spiral. The market provides us opportunity, opportunity helps us raise the funds, the funds employ the people, the people develop the technology and the technology feeds the market place.

2. Build a Plan

The second way of thinking about how to build a company is to follow a wonderfully simple process:

Plan, People, Process and Values

I thank Kip Smith for providing me with this simple, but effective way of thinking about company building. Many of the most wonderful things in life are so simple, and this is one. These elements seem so simple and so obvious and yet I never thought about how they integrate together until I met Kip.

The Plan allows us to chart our course and the People are the key resource to execute on the plan. What I find very interesting are the roles processes and values play.

Process is the means to overcome lack of communication.

If we all shared our thoughts completely and understood what we each were thinking, the need for process would be minimal. When you have two people, there is one line of communication, when a third person is added there are now three lines of communication. With four people the lines of communication rises to 6, with five 12 and so on. Process is a means by which we efficiently address this exponential increase in the lines of communication as a company grows.

The best means of communications come from all working in close proximity together in the same room. If Brightside or NxtPhase were to have the processes of GE we would die under the weight. However, if GE were to have the processes of Brightside it would be dysfunctional and fail. Thus it is important to manage process to the appropriate scale of the company.

As a person who is process challenged and action oriented, I prefer small companies because we have few and simple processes.

Values more than any other attribute define a company. Values provide a common framework within which to operate and will be different for each company and indeed for each person. A good value set will allow decisions to be pushed down in an organization and liberate speed, while at the same time maintaining consistency and quality in the decision making process. At Brightside our values fall into four core areas: Performance, Respect, Integrity and Decision Making. Under each of these areas we have simple and effective guidelines that help us all channel our energy and enthusiasm in a consistent and high quality manner.

Values are easy to adopt when things are going well. However, their real value comes when an organization is under stress and has difficult choices to make. This is where well developed values provide a touchstone on which to anchor us and through difficult decisions.

Values may sound trite and simple, but they provide confidence to our people and prevent us from decisions that might seem effective, but in fact could be folly. A classic example is Enron, where the lack of a good value set led to ruin for investors and employees.

Q: Please share your ten most valuable lessons from your experiences with NxtPhase? What would you do the same and differently?

A:

1) You cannot take everyone’s advice

I recall going into a presentation one morning with a

venture capital company with a series of projections, going out ten years that

had taken days to prepare. When the slide came up I was roasted:

“How can you possibly project out 10 years?

If you know what is going to happen two years from now I’d be surprised. Five

is the most anyone should use.”

I left with my tail between my legs, reworked the

spreadsheet frantically over lunch, cut the numbers down to five years and went

into my next meeting with another VC in the afternoon.

“What on earth is this? How

do you expect us to get a true sense of the business potential if you only

present five years of data. Don’t you understand that small companies take time

to grow?”

2) Technology and product are two different things

This is a hard lesson to learn, but a very important one. Technology companies rely on invention, and inventive people want to come into work and do something new and different every day. It is fantastic but a disaster when it comes to a product. For a product you need to ship the same thing today, and tomorrow, and next week, and next month. The design must work and be frozen until the next logical revision. Technology people want to add every new idea every day – this has two problems: first you never have a product; second, everything you ship is different, and it becomes a nightmare to service.

3) Root cause of problems: assumptions and communication

Building on the last point I shall never forget the day when the smartest Ph.D. inventor I have ever had the pleasure to work with came to me. He told me he had achieved everything he had signed up for when he joined the company - that the product worked. I looked at the pile of components in incredulity. It wasn’t close to being a product. In his mind every element worked, it gave the right result and the rest was just engineering to stick the bits together. “The rest” took two years to do!

I had assumed that everyone had the same understanding of the product as I had and had failed to communicate the requirements so the finish line was the same for everyone.

4) Program managers are an under-estimated resource

A good program manager is worth his weight in gold. The above example illustrates the absolute need to have an individual who can define, communicate, track and wrestle a program to the ground.

5) Building for the times

NxtPhase was built during the times of the stock market bubble when everything was over valued and money was easy to get. The mantra at the time was build, grow, reach 100 people as fast as you can, money is no object.

In hindsight we should have built the business more carefully and with a smaller team that would have had a much lower burn rate. The cash would have lasted longer and growth would have been more in line with market and sales potential.

6) If you are offered a chance to sell, think very hard before turning it down

In 2000 I was approached with a tentative offer to purchase NxtPhase, but didn’t even give it a second thought as the value was so far off expectations during the bubble. Of course after the bubble burst the offer looked very attractive, but by then it was too late.

7) The structure of a financing is important

Today, I pay much more attention to the structure of a financial arrangement so that you consider the impact on all parties in the event of both upside and downside. I take a more pragmatic approach to risk management. One of the problems with venture capital financings is the different classes of preferred shares, all with their different terms. This leads to conflict between shareholders and non-alignment of interest. This is a major conundrum and one that the business and investment community needs to think very carefully about. With Brightside, (formerly Sunnybrook), we have worked hard to issue only common shares to ensure that interests are aligned, but this is still a non-perfect solution as it leads to severe limitations in the sources of capital available.

8) Cash is king

This is one of those trite but true statements. If you run out you’re in trouble. At Brightside we do a cash review every two weeks.

9) People – when it goes wrong it keeps you awake at night

With people, the biggest issue is their suitability or fit and you have to take action immediately. The longer you delay the greater the agony will be; and the more you will spend time on the poor people, when you should spend it on the good people.

Most people issues aren’t whether the individual is qualified; it is whether they fit with the team. The most agonizing example I had was a husband and wife team. Both were very smart and both were very qualified. One could work well as part of the team; the other was not a fit. I spent months trying to make it work and agonized away many sleepless nights over it. I had to part company with one and we lost the other, which was a terrible loss to the organization. However, without taking the action we would have blown apart. I just should have done it sooner.

10) Have a good value set

See my earlier comments.

Q: What recommendations would you make from your time at Harvard and the subsequent application of your education?

A: When I was seven years old, suffering from being dyslexic and barely able to read two words, my mother worked very hard to help. We read Arthur Ransom’s “Swallows and Amazons”. In that book there was a line I shall never forget, “If you’re given half a chance, grab it with both hands.”

Rolls Royce gave me half a chance to go to Harvard. It was a fantastic experience and I strongly urge people to really reach high when it comes to their education.

I often joke that I did two MBAs, one at Harvard and one at NxtPhase. You can’t learn to ski by reading a book. In the same way you can’t learn to run a business by doing an MBA. You have to get out there and do it. You fall a few times and the difference between success and failure is whether you are prepared to pick yourself up again and try again.

Harvard provided the foundation of knowledge and NxtPhase the experience of hard knocks. The other fantastic attribute it brought was access to a wealth of highly knowledgeable people. At any time, on any subject you find access to world experts. If I were to undertake an MBA again, I would spend less time worrying about the course work and more on developing the relationships, as it is these that really mattered after the event.

Q: What prompted you to start Brightside? What are its roots and where do you see the company evolving?

A: Brightside is focused on high performance displays that may be used as computer monitors or televisions. They have a ‘wow’ performance that really sets them apart from anything anyone else has done.

Like NxtPhase, BrightSide is a spin-off from the University of British Columbia. When I left NxtPhase, David Jones of UBC approached me to have a look at some other technologies that are in the portfolio. I was introduced to Lorne Whitehead and two of his students, Michele Mossman and Helge Seetzen. They had some very interesting ideas, a proven track record of invention and some very good demos of their technology.

I looked at a number of different opportunities, but there seemed such a wonderful opportunity to work together to mould a company around the nucleus at UBC. The one problem we had was that they wanted me to start the day after finishing at NxtPhase, but I needed a break and took the summer off. They were kind enough to wait.

The company has a mission to build the most spectacular displays in the world. We will introduce products for professional applications based on our technology, and license it to the large consumer electronics companies to introduce consumer products. Our expertise is in invention and so we intend to outsource our operations for product manufacture to those experienced in this area. This will allow us to stay focused and grow without having to add large fixed costs.

Q: Who are the key figures supporting Brightside (management, engineers, scientists, board members, advisory board members, and so on)? What prompted their interest?

A: The company came out of the Structured Surface Physics Lab where Lorne Whitehead is recognized as a world leader in this field. Four spin-off companies and technology that has been licensed around the world has come out of this stable. Lorne has over 150 patents with his name on, and since going back into academia a decade ago, has produced a patent a month. A year ago he became the Vice President Academic and Provost of UBC.

Helge Seetzen is one of the most rounded and smartest people I have ever met. He is young, speaks four languages fluently and did his degree in physics, while simultaneously doing a degree in philosophy. It is an honour to work with him.

UBC is a critical supporter of the company and owner of stock in the company. Without the support of David Jones, Angus Livingstone and the UILO, Brightside would not exist.

We have also had tremendous support from the angel community in Vancouver who have had the confidence to invest. Leaders include Don Rix and Don Graham, Brent Tynan, the BC Advantage Fund and WUTIF.

Brightside has built a technical advisory board that is exceptional. It includes Gary Thomas, the former CTO of Philips Displays, Lorne Whitehead and Wolfgang Hiedrich from UBC, Karol Muskowski from the Max Planck Institute in Germany and Alan Chalmers from Bristol University in England.

We are fortunate in being able to build a management team that is also exceptional. In addition to Helge Seetzen, we have Doug Campbell a Nortel veteran, Gary Yurkovich from DEC and Creo, and Neil McPhail and Mark Grist both of whom have great startup experience.

The common thread that attracted this group of people is the belief that there is tremendous opportunity in the future of Brightside. The opportunity to do something that has never been done before, the opportunity to work with exceptional people, the opportunity for financial return. We are changing the world and it is fun and rewarding to be part of it. For some, such as Dr. Rix, there is also the chance to give back what they have had the good fortune to receive over the years.

Q: Share your views on current displays and where your technology differs?

A: The display industry is in the middle of a huge paradigm shift. Fifteen years ago there was one technology – the cathode ray tube (CRT), which came to the fore in 1935, when the Marconi “all electronic television” displaced the mechanical television invented by John Logie Baird in 1926 during a showdown run by the BBC.

CRTs are still the dominant technology today – enduring for 70 years. However, ten years from now they will be a small portion of the market. The question is, what will replace them: Plasma, LCD, DLP, LCOS, SED? The question may be one of price and performance, but the greatest driving force is probably investment. We have seen a huge amount of money put into LCDs, which led me to believe that LCD will be the winners and that other technologies will fade, including the popular Plasma TVs. For projection systems the jury is still out, both LCOS (liquid crystal on silicon) and DLP (digital light projector) are in the running.

Brightside has aligned to be able to work with LCD, LCOS or DLP and thus the technologies most likely to succeed the CRT are covered.

We enhance the experience seen by the viewer by making the displays 10 times brighter, while maintaining black levels that are 10 times blacker. This gives us a contrast of over 100 times that of conventional TVs. At the same time our display is a 16 bit display, allowing us to show more shades per colour than the human eye can see – unlike conventional displays, which show just 256 shades.

I was in a meeting when someone said, “this is an MCT technology.” I asked what on earth is MCT. “Mom Can Tell.” Brightside has a technology that you can show to anyone and immediately they understand that it is better. Seeing is believing.

Q: What were the major technical challenges that you had to overcome?

A: We have had to prove to the world that our approach would work; this we have done successfully. The biggest challenges have been to develop the algorithms that are fast enough to run the display (this we have done) and to remove the heat. The good news here is that we use LEDs that are becoming twice as efficient every 18-24 months – thus the industry is working in our favour.

Q: What are your top business challenges and what is your recipe for overcoming them?

A: Like many small companies we have more opportunities than we know what to do with. This leads to a conflict between desire and resources, both financial and human. We have to pick a direction and execute on our plan within the limitations of our level of available funding. By demonstrating success and building an exceptional team with a proven track record, we are able to gain the financing we need to execute on our plan. Part of that plan has been to work with partners in the industry, and after some significant hard work, we are making good progress.

Q: Describe the entire business ecosystem to be impacted by your company’s research and how do you hope to address the opportunities?

A: The words in this question are too complex for me. I can only keep about 2 or 3 thoughts in my head at any one time, so the plans have to be kept simple. When people see what we have, they would prefer it to the display they have today, or any that you can currently buy. So the objective is simple – get this technology widely adopted in the world. How do we do that? We are unlikely to become a large consumer display company like Sharp, Samsung, Sony or LG Philips, so we have to partner with these people. We aim to license our technology to them. This means lots of travel to Asia and Europe to provide a demonstration and negotiate agreements to develop and license products based on our technology.

However, due to cost, the displays will take time to be adopted into the consumer market and so we have to seed the market in an area that will support the higher initial costs. This is being done in markets which can take advantage of what we have to offer, such as satellite imaging, film post production, military, medical imaging etc.

What then becomes really interesting is the change to 16-bit image processing, which will happen over the next few years. We are well positioned to take advantage of this shift and have already developed technology that covers the whole image pipeline from image capture, to storage, processing and display.

I think that is three thoughts, so my mind must be full.

Q: What are the applications for your technology?

A: Two applications: If you have data that is greater than you can display on a regular display then we are idea. The film post production industry is a good example. Film is much better than your television, but when they do the special effects they use a computer monitor to develop the content. When they merge the special effect with the film content, mistakes can be made due to the lack of performance of the display. These mistakes can be expensive – a $100,000 to reprint a scene from a film.

The second application is emotional – it looks better. This is an ideal consumer application where people can see a better product.

Q: Your commercially available DR 37P, 37-inch high dynamic range (HDR) LCD panel was anticipated to be released at SIGGRAPH 2005. Who will be buyers?

A: Our early customers include the large display companies who form our partners for commercialization, and those with specific need. An example in the film space is Technicolor and in the consumer electronics space is Sharp.

Q: When do your forecast your technology to be at a price point where it’s available to the mass market?

A: It will take 2-3 years for the product to be available in the high end of the consumer market place, and will then work its way into more and more affordable displays.

>Q: Richard, thank you for taking the time to do this interview and providing a glimpse into the processes and challenges for a technology innovator.

A: It is a pleasure. Thanks.